End-to-End Delivery

300+

Projects completed

16+

Awards Received

12+

Years of experience

100+

Team members

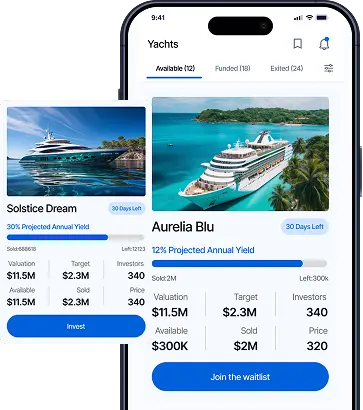

As a leading RWA tokenization development company, Alpharive builds enterprise-grade platforms that bring physical and financial assets into the digital economy. Our team designs secure blockchain frameworks, enabling investors to trade tokenized assets with full transparency, compliance, and real-time settlement.

The tokenization of real-world assets is changing how businesses manage ownership, value transfer, and investment opportunities. Alpharive’s solutions bridge the gap between traditional assets and decentralized finance (DeFi), allowing institutions and startups to launch RWA platforms that deliver trust, interoperability, and seamless trading experiences.

Tokenization extends across multiple industries, transforming static assets into digital units that enhance liquidity and accessibility worldwide.

By tokenizing real estate, investors can own fractional shares of properties and trade them globally without intermediaries. Alpharive develops blockchain-backed real estate tokenization platforms that simplify property management, increase liquidity, and unlock new investment models for residential and commercial sectors.

Tokenization of commodities like gold, oil, and agricultural assets allows real-time trading with secure blockchain tracking. Alpharive’s tokenization systems ensure transparent price discovery, simplified custody, and easy redemption, bringing efficiency and accessibility to the global commodities market.

From luxury art to vintage cars, Alpharive helps digitize high-value collectibles through NFT and RWA token frameworks. This approach secures proof of ownership, ensures authenticity, and allows collectors to trade valuable items globally without traditional market barriers.

Private equity tokenization opens early-stage investments to a wider audience while improving liquidity. We build platforms that let investors participate in tokenized equity shares with automated compliance, investor tracking, and transparent capital flow management.

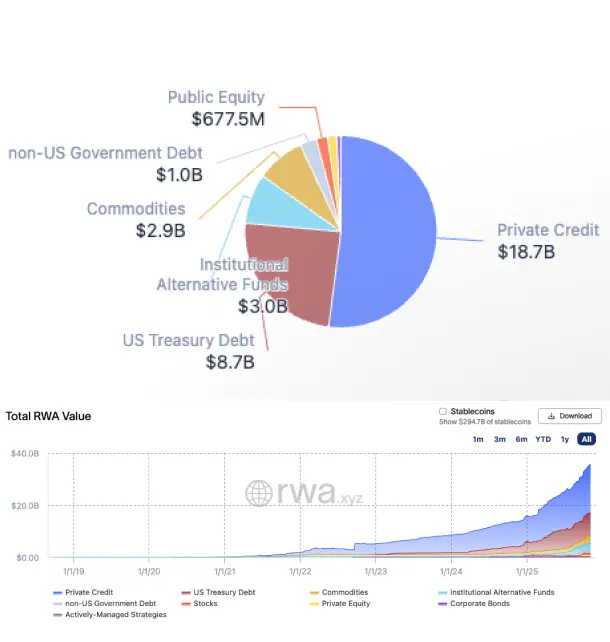

The global RWA tokenization market is expanding rapidly, projected to exceed trillions in value within the next decade. According to BlackRock CEO Larry Fink, digital asset tokenization will be “the next generation for markets,” highlighting its potential to reshape global finance.

Institutional interest from major players across the U.S. and Europe continues to validate this growth. Alpharive’s RWA platforms align with this trend by providing scalable blockchain solutions that meet the needs of enterprises, regulators, and investors entering the tokenized asset ecosystem.

Key RWA Market Insights:

Artificial Intelligence enhances every stage of asset tokenization from valuation and compliance to trading and risk analysis. We integrate AI models to automate due diligence, predict asset performance, and maintain compliance with real-time monitoring systems.

Beyond automation, AI-driven insights improve investor decision-making by assessing liquidity metrics and portfolio diversification. By combining blockchain security with AI intelligence, Alpharive delivers platforms that are not only innovative but also intelligent, efficient, and data-driven.

Alpharive supports multiple blockchain token standards to ensure flexibility, compliance, and interoperability across ecosystems.

ERC 20

ERC 20 is ideal for fungible tokens that represent fractional ownership of assets, enabling seamless trading across decentralized exchanges and wallets.

ERC 1404

ERC 1404 simplifies regulatory compliance by enforcing transfer restrictions and KYC requirements directly within the token’s smart contract logic.

ERC 721

Non-fungible tokens (NFTs) under the ERC 721 standard enable the representation of unique assets, making them ideal for real estate titles, artworks, and collectibles.

ERC 1155

ERC 1155 supports both fungible and non-fungible tokens within a single smart contract, improving efficiency for multi-asset tokenization projects.

ERC 3643

Designed for real-world assets, ERC 3643 provides identity verification and compliance features that meet institutional and regulatory standards.

ERC 1462

ERC 1462 introduces standardized compliance layers for security tokens, allowing businesses to issue regulated digital securities with global compatibility.

Asset tokenization offers tangible benefits for investors, businesses, and financial institutions seeking to bridge the physical and digital markets.

Enhanced Liquidity

Tokenized assets can be traded anytime, anywhere, unlocking liquidity for traditionally illiquid assets like real estate and private equity.

Global Accessibility

Blockchain-based tokens eliminate geographical restrictions, giving investors around the world equal access to diversified asset opportunities. .

Fractional Ownership

Tokenization divides high-value assets into smaller units, allowing investors to participate without significant capital requirements.

Transparency and Security

Blockchain ensures every transaction is transparent, immutable, and verifiable, protecting both investors and asset owners.

Automated Compliance

Smart contracts automate KYC, AML, and regulatory checks, ensuring consistent adherence to global compliance standards.

Alpharive follows a structured and transparent development cycle to deliver secure and scalable RWA tokenization platforms.

1

Requirement Gathering

Our experts collaborate with stakeholders to define asset classes, compliance needs, and target user experience for the RWA platform.

2

Blockchain Selection

We choose an optimal blockchain protocol based on scalability, transaction cost, interoperability, and regulatory alignment with the asset type.

3

Architecture Design

Architects map smart contract flows, token standards, and governance mechanisms to ensure security and high system performance.

4

Smart Contract Development

Our team codes and audits smart contracts that handle compliance and trading operations with precision and transparency.

5

Token

Assets are digitized into blockchain-based tokens, each mapped to real-world value and verified through secure asset validation processes.

6

Platform Integration

Integration connects wallets, custodians, and exchanges, enabling investors to trade tokenized assets effortlessly across platforms.

7

Testing and Compliance

Rigorous functional, security, and regulatory testing ensure the platform meets institutional standards for performance and trust.

8

Deployment and Maintenance

After launch, Alpharive provides continuous upgrades, monitoring, and support to maintain compliance and adapt to evolving regulations.

Alpharive stands as a trusted partner for enterprises seeking a full-spectrum blockchain development company. As a top-tier asset tokenization development company, Alpharive combines blockchain expertise, AI integration, and robust compliance architecture to deliver high-performance RWA tokenization platforms. Businesses across the U.S., Europe, and beyond rely on Alpharive’s precision-driven development and industry insights to lead the future of digital finance. Talk to our experts and launch your tokenization platform in weeks.

End-to-End Delivery

Global Reach

Scalable Architecture

AI Integration

Security First

Blockchain Expertise

Regulatory Compliance

Contact Us

Partner with Us for Comprehensive IT Solutions

We’re happy to answer any questions you may have and help you determine which of our services best fit your needs.

Your benefits:

Client-oriented

Independent

Competent

Results-driven

Problem-solving

Transparent

Schedule a Free Consultation