Continuous

Support

300+

Projects completed

16+

Awards Received

12+

Years of experience

100+

Team members

Insurance software development focuses on building digital solutions that simplify policy management, claims handling, customer communication, and compliance. These platforms help insurers improve accuracy, efficiency, and user experience across operations. They also support regulatory adherence by embedding compliance features that safeguard businesses from penalties and operational risks.

With the increasing complexity of insurance processes, companies need tools that reduce errors, enhance decision-making, and deliver faster services. Custom-built insurance platforms achieve this while keeping systems flexible and ready to evolve with market needs. In addition, they enable seamless integration with third-party systems, ensuring insurers can expand functionalities without disrupting existing workflows.

Our insurance software development services cover every critical function required to manage policies, claims, risks, and customer engagement.

Automate policy creation, updates, and renewals with solutions that ensure accuracy, compliance, and faster customer onboarding.

Streamline claim submissions, validation, and settlement with platforms that reduce delays and improve transparency for customers.

Enable accurate risk evaluation using data-driven models that support better underwriting and policy pricing decisions.

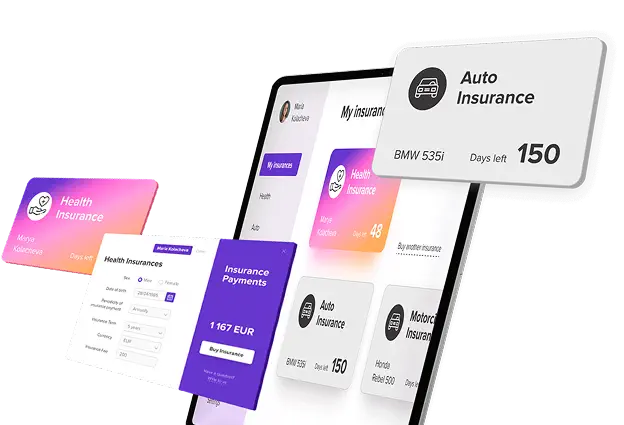

Provide secure, self-service portals that allow customers and agents to manage policies, track claims, and access support anytime.

Simplify premium collections with integrated billing and payment systems supporting multiple payment modes and real-time tracking.

Leverage data-driven insights through custom reporting dashboards that enhance performance monitoring and regulatory compliance.

Custom insurance software development focuses on building solutions tailored to unique business workflows, specific customer needs, and regulatory standards. Unlike off-the-shelf products, custom platforms give insurers complete control over scalability, integrations, and innovation.

This approach ensures insurers gain a competitive edge with flexible systems that adapt to emerging technologies and evolving market requirements. Personalized insurance solutions also drive better engagement by aligning closely with client expectations.

We integrate advanced technologies to enhance insurance software performance, security, and intelligence.

Blockchain ensures transparent transactions, secure data sharing, and immutable recordkeeping for policies, claims, and settlements. It further reduces operational costs by eliminating intermediaries and speeding up verification processes across multiple stakeholders.

AI improves fraud detection, claims automation, and customer support while enabling predictive insights for better risk management and underwriting accuracy. It also personalizes customer experiences by analyzing data patterns to recommend suitable products and faster resolution pathways.

Cloud platforms deliver scalability, seamless integrations, and real-time access for insurers, customers, and partners across multiple devices. They also strengthen disaster recovery and business continuity by offering secure backups and quick system restoration.

Our insurance software development process combines industry expertise with a structured approach to deliver reliable solutions.

1

Planning

We begin by identifying core insurance needs, compliance requirements, and workflows to design a roadmap aligning with business objectives.

2

Designing

Detailed wireframes and intuitive UI designs are created to ensure smooth user experiences for both insurers and policyholders.

3

Developing

Custom-coded modules are built to handle policy, claims, and risk management with scalable architectures and robust integrations.

4

Testing

Each feature undergoes rigorous validation for functionality, accuracy, and security to minimize operational risks and compliance issues.

5

Deploying

Final solutions are rolled out with seamless integration into existing environments and guided user onboarding for smooth adoption.

6

Maintaining

Post-deployment support, upgrades, and monitoring ensure long-term software performance and alignment with evolving regulations.

Alpharive brings expertise, innovation, and industry knowledge to build insurance software that simplifies complex processes and improves customer engagement. With a strong focus on scalability, compliance, and emerging technologies, our solutions empower insurers to stay ahead in a competitive market. Beyond technical capabilities, our experts emphasize collaboration and transparency throughout every project stage, ensuring clients receive solutions aligned with their goals. Connect with our experts today and take the next step in building a smarter insurance future.

Continuous

Support

Scalable

Architecture

User-Centric Design

Seamless

Integrations

Data Security

Faster Time-to-Market

Regulatory Compliance

Contact Us

Partner with Us for Comprehensive IT Solutions

We’re happy to answer any questions you may have and help you determine which of our services best fit your needs.

Your benefits:

Client-oriented

Independent

Competent

Results-driven

Problem-solving

Transparent

Schedule a Free Consultation