Custom

Strategies

300+

Projects completed

16+

Awards Received

12+

Years of experience

100+

Team members

Crypto trading bot development focuses on building automated solutions that execute trades faster and smarter than manual processes. These bots analyze market conditions, detect profitable opportunities, and act instantly, enabling traders and businesses to optimize strategies, reduce risks, and operate round-the-clock in highly volatile crypto markets.

At Alpharive, crypto trading bots are engineered with precision, combining algorithmic trading models, API integrations, and advanced analytics. Each solution is customized to client requirements, whether for arbitrage, high-frequency trading, or portfolio management, ensuring seamless performance, strong security, and scalability for long-term success in digital asset trading.

An AI trading bot development company leverages artificial intelligence to build solutions that analyze vast market data and adapt strategies automatically. These intelligent bots enhance decision-making, minimize human errors, and ensure traders respond to opportunities faster than traditional methods in unpredictable financial environments.

Alpharive, as an AI trading bot development company, delivers advanced bots equipped with predictive analytics, machine learning algorithms, and real-time monitoring. Each solution is designed to evolve with market shifts, giving clients sustainable advantages through automated accuracy, secure performance, and scalability across multiple crypto exchanges and trading platforms.

Trading bot development services from Alpharive cover diverse strategies, delivering automated solutions tailored to unique trading goals and dynamic market opportunities.

Arbitrage bots automatically exploit price differences across multiple exchanges, helping traders generate consistent profits with minimal risk through rapid, accurate execution and reliable multi-exchange connectivity.

MeV bot development focuses on capturing on-chain transaction opportunities, allowing traders to gain competitive advantages by securing profitable positions within blockchain ecosystems efficiently and strategically.

Signal bots analyze technical indicators, patterns, and custom trading signals, automatically executing trades with precision to help investors capitalize on favorable entry and exit points consistently.

Sniper bots are designed to execute trades instantly when market conditions match predefined rules, giving traders faster reaction times and higher accuracy in volatile market situations.

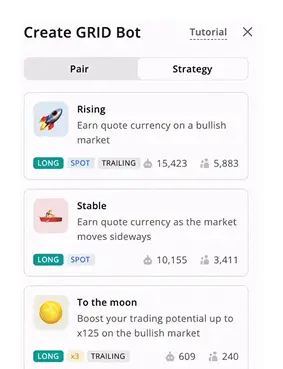

Grid trading bots automate buying and selling within set price ranges, enabling systematic profit generation while reducing risk exposure and maintaining consistent trading activity across markets.

Custom trading bots are tailored to individual strategies, integrating specific algorithms, APIs, and security measures to provide traders with a unique, scalable, and performance-driven automated solution.

Our AI Trading Bot Development approach blends algorithmic strategy design, rigorous data workflows, and production-ready integration for reliable automated trading.

1

Gather Requirements

Define functional and nonfunctional requirements, target markets, asset types, latency tolerances, and compliance constraints before the design begins.

2

Collect Data

Aggregate historical market, order book, on-chain, and alternative data sources, ensuring sufficient depth, granularity, and precise timestamp alignment.

3

Engineer Features

Extract technical indicators, time-series features, sentiment embeddings, and lagged variables to create inputs that improve model predictive power consistently.

4

Design Strategies

Define algorithmic strategies, including market-making, momentum, arbitrage, and mean-reversion, specifying execution rules, risk thresholds, and slippage tolerances explicitly.

5

Train Models

Train machine learning and deep learning models using cross-validation, hyperparameter search, and time-series-aware splits to prevent lookahead bias.

6

Backtest Strategies

Backtest strategies on historical tick and candle data, simulating realistic latencies, fees, and order execution to measure performance.

7

Integrate Exchanges

Integrate with exchange APIs, handle rate limits, manage keys securely, and normalize order book formats for consistent trading.

8

Implement Risk Controls

Embed risk controls such as position sizing, stop-loss, max drawdown, and real-time exposure monitoring to protect capital effectively.

9

Deploy & Monitor

Deploy the trading bot securely on live environments, continuously monitor performance, and refine strategies based on market feedback.

Trading bots bring unmatched efficiency, speed, and accuracy, helping traders navigate volatile markets with consistent performance.

Automation

Bots eliminate manual intervention by executing trades automatically, ensuring traders never miss profitable opportunities in fast-moving markets.

Speed

Orders are executed instantly with minimal latency, allowing traders to capture fleeting price movements and maximize profits effortlessly.

Consistency

Automated bots follow predefined strategies without emotional influence, delivering disciplined and reliable execution under all market conditions.

Scalability

Trading bots handle multiple exchanges and assets simultaneously, empowering traders to expand strategies without added operational complexity.

Risk Control

Integrated safeguards, such as stop-loss, exposure limits, and capital allocation, help minimize losses and protect investments effectively.

24/7 Trading

Bots operate continuously across global markets, enabling round-the-clock participation and profit-making even while traders are offline.

HTML

C++

JavaScript

Angular

React

Meteor

Vue.js

net

Java

Node.js

Go

C++

Python

iOS

Android

Flutter

React Native

C++

Csharp

Qt

Swift

Objective-c

aws

Google Cloud

Azure

Digital-Ocean

Ethereum

Binance

Solana

Polygon

Avalanche

Alpharive stands out as a trusted trading bot development company by combining technical precision with deep market expertise. Our solutions are designed for scalability, speed, and security, ensuring clients gain reliable tools to trade with confidence. From AI-driven strategies to seamless exchange integrations, every bot is built to deliver measurable value and long-term growth in competitive digital markets. Build your next-gen trading bot with Alpharive’s experts and stay ahead in automated trading innovation.

Custom

Strategies

Performance

Monitoring

Scalable Architecture

Exchange

Integration

Risk

Management

Industry Expertise

AI Algorithms

Contact Us

Partner with Us for Comprehensive IT Solutions

We’re happy to answer any questions you may have and help you determine which of our services best fit your needs.

Your benefits:

Client-oriented

Independent

Competent

Results-driven

Problem-solving

Transparent

Schedule a Free Consultation