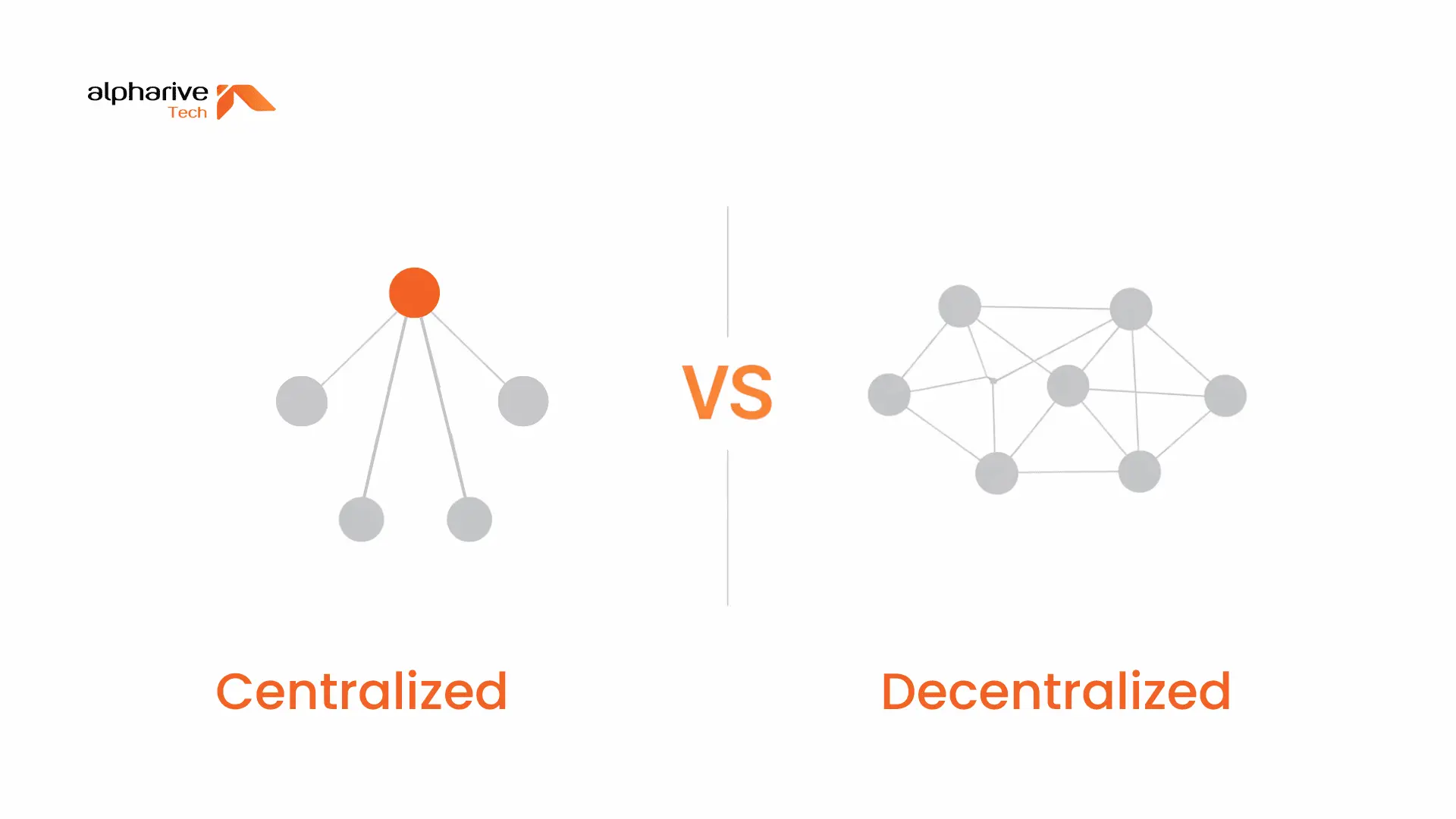

The rise of crypto exchanges has reshaped how digital assets are traded, stored, and managed across global markets. Early platforms focused on ease of access and speed, while newer models emphasized transparency and user control. This shift has led to a growing discussion around centralized vs decentralized exchange models and how each fits different use cases. As blockchain adoption expands, businesses and users alike are weighing CEX vs DEX options to decide which structure aligns better with their trading goals, compliance needs, and long-term strategy. Understanding these differences is essential either for building or using crypto platforms effectively.

Centralized exchange is often the first question asked by new crypto users entering the market. A centralized exchange is a platform operated by a single organization that manages trading activities, user accounts, and transaction execution. In this model, the exchange acts as an intermediary between buyers and sellers, matching orders through an internal system.

A centralized exchange typically controls user funds through custodial wallets, meaning assets are stored and managed by the platform rather than individual users. Understanding how centralized exchanges work involves recognizing their reliance on traditional backend infrastructure, order books, and compliance layers. This setup allows for faster transactions, high liquidity, and familiar user experiences, which is why many large trading platforms follow this approach.

When exploring a decentralized exchange, the conversation shifts toward autonomy and trustless systems. A decentralized exchange enables peer-to-peer trading without relying on a central authority to hold funds or approve transactions. Instead, trades are executed directly on the blockchain.

A decentralized exchange operates through smart contracts that automatically handle trade execution based on predefined logic. Learning how decentralized exchanges work means understanding non-custodial systems where users maintain full control over their private keys and assets. This model reduces reliance on intermediaries and aligns closely with the core principles of blockchain decentralization.

The distinction between centralized vs decentralized exchange models becomes clearer when examining how each processes trades and manages control.

In a centralized model, the work revolves around internal order books, managed liquidity pools, and platform-controlled wallets. Users deposit assets into the exchange, place buy or sell orders, and the system matches them instantly. The platform oversees everything from KYC verification to transaction settlement.

How Decentralized Exchanges Work

On the other hand, decentralized exchanges work is driven by blockchain-based execution. Trades occur through smart contracts, often using automated market makers instead of order books. Users connect wallets directly, approve transactions, and retain asset ownership throughout the process.

A clear centralized vs decentralized exchange comparison helps stakeholders understand trade-offs at a structural level. From an operational standpoint, CEX vs DEX platforms differ in security responsibilities, liquidity models, and overall control, making a crypto exchange security comparison especially important.

| Feature | Centralized Exchange | Decentralized Exchange |

| Custody | Platform-controlled | User-controlled |

| Control | Central authority | Smart contracts |

| Liquidity | High, aggregated | Fragmented or pool-based |

| Fees | Platform-defined | Network and protocol fees |

| User Experience | Simple, familiar | Wallet-based, technical |

Security remains one of the most critical decision factors, making crypto exchange security comparison a priority for both users and enterprises.

Centralized exchange security depends heavily on the platform’s internal safeguards, including cold wallets, multi-signature systems, and monitoring tools. While these measures can be robust, custodial control introduces risks such as single points of failure and large-scale breaches if systems are compromised.

Decentralized exchange security shifts responsibility toward smart contract integrity and user behavior. While there is no central honeypot for attackers, vulnerabilities in contract code or improper wallet management can still expose risks. Security audits and formal verification become essential here.

From a technical standpoint, centralized exchange architecture is built around traditional server-based infrastructure integrated with blockchain nodes. This setup enables high-speed trading, advanced analytics, and controlled upgrades.

Decentralized exchange architecture relies on on-chain logic, smart contracts, and blockchain networks to manage trades. Liquidity management CEX vs DEX models also differ significantly, with centralized platforms using order books while decentralized systems rely on automated market makers. Backend complexity is replaced by transparent, programmable logic on-chain.

Understanding CEX vs DEX pros and cons allows users and businesses to align technology choices with goals.

When asking which is better, CEX or DEX, the answer depends on user profiles. Beginners often prefer centralized platforms for simplicity and support. Advanced traders may value decentralized platforms for autonomy and transparency. Businesses evaluate both models based on compliance, scalability, and operational control.

For organizations, centralized vs decentralized exchange for enterprises is not just a philosophical choice it is a strategic one. Enterprises require enterprise crypto exchange solutions that address regulatory compliance, liquidity depth, system scalability, and governance controls. Centralized models often suit regulated environments, while decentralized frameworks appeal to innovation-driven ecosystems and niche markets.

From a development perspective, centralized crypto exchange development focuses on performance optimization, backend security, and regulatory alignment. It involves complex order-matching engines, user management systems, and compliance modules.

In contrast, decentralized exchange development emphasizes smart contract engineering, blockchain integration, and protocol security. Choosing a capable CEX development company or DEX development company depends on technical depth, architectural planning, and long-term maintenance capabilities.

Alpharive approaches centralized crypto exchange development and decentralized exchange development with a strong focus on scalable architecture, security-first design, and business alignment. The team builds enterprise crypto exchange solutions tailored to specific market needs, whether that means high-volume trading platforms or decentralized protocols with custom liquidity models. By balancing innovation with operational stability, Alpharive helps businesses launch exchanges that are built to perform, adapt, and grow in competitive markets.

The debate around centralized exchange vs decentralized exchange highlights one key truth: there is no universal solution. Each model serves different goals, risk appetites, and operational requirements. Whether evaluating CEX vs DEX from a user or enterprise standpoint, the right choice depends on strategy, scale, and long-term vision. With the right technology partner, businesses can navigate these options confidently and build platforms designed for real-world success. Talk to experts and build your solution with us.

Recent Insights

Contact Us

Partner with Us for Comprehensive IT Solutions

We’re happy to answer any questions you may have and help you determine which of our services best fit your needs.

Your benefits:

Client-oriented

Independent

Competent

Results-driven

Problem-solving

Transparent

Schedule a Free Consultation